After legislative changes in 2008 many non-resident owners of property in Spain were under the misconception that they can forget about submitting their annual tax forms!

It would be nice but it is not the case.

Up until the end of 2007 all non-residents with property in Spain were also liable to pay a “wealth tax” (Patrimonio) which was calculated on the value of their assets in Spain (i.e. property, savings, etc.)

With the introduction of Spanish Law 4/2008 passed on the 23 December 2008, the tax was amended by reducing the taxable base to zero. Is this technically a formal abolition of the Tax? The answer is no. Certainly the effect was that no wealth tax was paid by either residents, (obligación personal) or non-residents, (obligación real) for the tax years 2008 payable 2009, 2009 payable 2010 and 2010 payable 2011.

By reducing the tax to zero in 2008 but not abolishing it, the Spanish Government retained the option to re-introduce the tax which they did on the 16 September 2011.

By reducing the tax to zero in 2008 but not abolishing it, the Spanish Government retained the option to re-introduce the tax which they did on the 16 September 2011.

However this latest about turn only affected higher-end taxpayers both residents (obligacion personal) and non residents (obligacion real) alike.

Only those with assets of over 700,000 euros (excluding that of their primary residence IF they are fiscally resident) are liable and primary residences with a value of up to 300,000 euros are exempt.

The tax rate will vary between 0.2 and 2.5%, depending on the contributory base after allowances.

Logically if you are fiscally non-resident your primary residence can not be in Tenerife.

The increase in the % of the tax was expected to remain in place for just 2 tax years, 2011 payable 2012 and in 2012 payable 2013 but is still applicable at the time of writing in 2017

So to reiterate, the Patrimony “wealth tax” is not applicable to all taxpayers.

But that does not mean that if you are not liable for Patrimony there are no annual property taxes for Non-Residents to pay.

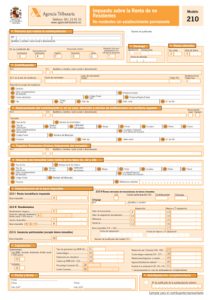

The “Declaración de la Renta de Non Residentes” or “Non Resident’s annual tax return” modelo 210 must still be made and paid regardless of the amount of assets a taxpayer has!

Taxation, and particularly dual taxation issues are an extremely complicated subject, not least because of laws regarding touristic letting, and I would always advise readers who make financial gain from their property in Spain to get a qualified assessment of their own personal circumstances, either directly from the Spanish “Hacienda”, Spain’s Inland Revenue, or from a tax professional.

However, in general terms since 2010 the earnings from rented property or sub-let property were calculated on 24 per cent, 24.75% for income from the 1/1/2012 until 31/12/2014 and then

2015 payable in 2016 is:

Contributors who are fiscally resident in the EU, Iceland and Norway: 19,5%

Rest of contributors 24%

and for the tax year 2016 & 2017 payable in 2017 & 2018

Contributors who are fiscally resident in the EU, Iceland and Norway: 19%

Rest of contributors 24%

…of the nett income received from the tenant, excluding IGIC.

Even If you DO NOT let out your Spanish property there is still a modelo 210 return to declare and a tax to pay more information here

Changes to Non Residents Income Tax (Property Let Out)

In the Official Gazette (BOE in Spanish) dated 2.03.2010, the Law 2/2010 has introduced a change in the Income Tax Law for European nationals who are Non Residents, changing the way they pay Income Tax on properties let in Spain. Up to 2010, non residents tax payers paid 24% ((24.75% for income from the 1/1/2012 until end of 2013) of the gross income on properties let in Spain,they were not allowed to deduct any expenses at all, there were examples when the tax paid could exceed 60% of the actual profit.

The European Union has pressed Spain to change this situation, and with the new Law, you can now deduct all expenses directly connected with the letting of the property: electricity, water, community fees, rubbish collection or local rates, maintenance, cleaning services, interest on mortgage (if applicable), professional fees, exactly in the same way as residents do.

However, it is not always straightforward. If you were letting your property 365 days per year, you could deduct all the expenses, but if you rent only a fraction of a year the expenses have to be pro-rata. For modelo 210 returns on income derived from Spanish property after the 1 January 2011 you will be required to obtain a CERTIFICADO DE RESIDENCIA FISCAL ( A certificate of fiscal residence) from your own tax authority office. This is valid for a period of one year from the date of issue. The certificate must be submitted with your Spanish tax return in order to prove fiscal residence in the UK (or indeedother European state except Spain) Under dual taxation exemptions you may be entitled to deduct the tax paid in Spain from your UK liability.

If the property is only rented out for part of the year, the earnings are calculated as above for the rented period. For the part of the year that it lies empty, the calculation is made as for “Deemed (Rental) Income”: see below.

It is important to point out that holiday letting for short periods of time is subject to very stringent regulations and may only be undertaken on registered Touristic complexes or if you are eligible, have obtained a “Vivienda Vacional” licence and have registered with the Administración Tributaria Canaria for IGIC sales tax returns, as income from legal touristic lets apart from income tax, also attracts IGIC tax (like VAT) at 7%. Infringement of touristic letting laws is punnished very severely see here and here.

Privately letting your property, which is owned on a residential complex, for lets of 3 months or longer is acceptable and does not attract IGIC although of course Non residents income tax as described above is still payable. You will also be required to provide a certificate of Energy efficiency:

And don’t forget the income from letting your foreign property MUST ALSO BE DECLARED IN YOUR OWN COUNTRY (probably the UK if you are reading this) For the UK the form is herehttp://www.hmrc.gov.uk/forms/sa106.pdf .

Under double impositions agreements Individuals who own property in Spain and who are not resident in Spain pay Spanish income tax in respect of the deemed income value (see below) of their Spanish property. This Spanish tax is not creditable against United Kingdom income tax liability because there is no UK tax payable in respect of the deemed Spanish income.

However where Spanish income tax is payable in respect of actual income from a Spanish property and actual rents are taxed in the United Kingdom the Spanish tax payable may be credited against the UK payable on the Spanish rental income.

Anyone treating apartment letting as a business

If someone owns property in Spain, but is not resident in Spain for tax purposes and has at least one office or premises used for managing the letting business and employs one or more people on a full time contract, then the owner is considered to have income through a permanent establishment in Spain and is subject to different regulations.

At The One Stop Problem Shop we can assist with preparing and presenting this tax. Please get in touch using the links below if you require our assistance.

Contact Us

📩info@theonestopproblemshop.com

![]() WhatsApp 659719695

WhatsApp 659719695

📞 922 783828 or 659719695